Which Hybrid Mutual Funds Suit Different Risk Profiles?

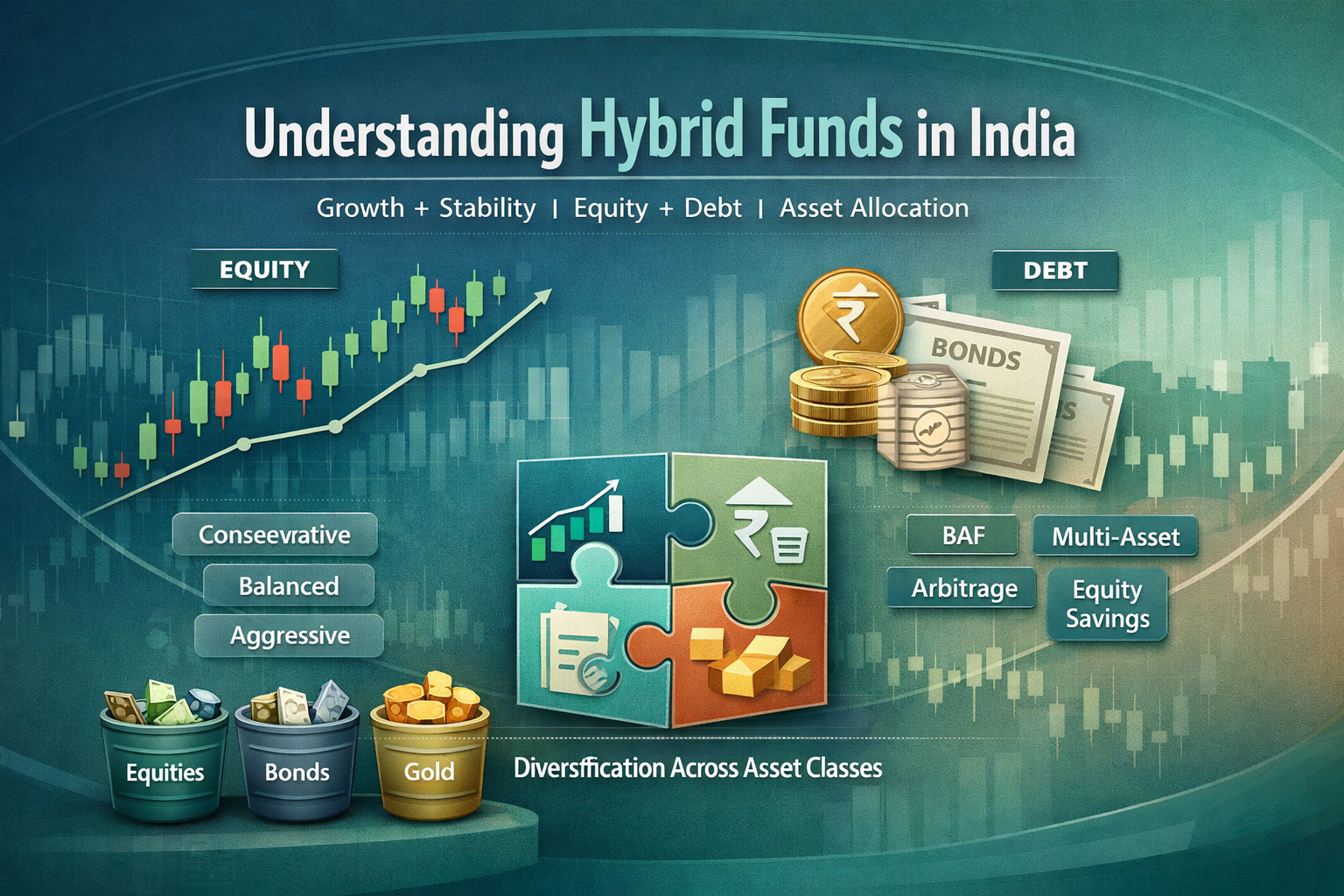

Hybrid Mutual Funds blend equity and fixed income in a single portfolio, offering a way to pursue growth while aiming to dampen volatility. In 2026, these funds remain a practical part of many Indian investors’ portfolios, especially for those who want diversification without managing multiple funds. This article maps common hybrid fund types to distinct risk profiles, helping readers pick a path that aligns with their goals and time horizon.

In this blogpost, I bring a practical, investor-focused approach to explaining how Hybrid Mutual Funds can fit into a prudent Indian investor's portfolio in 2026. I try to present a balanced, educational view while highlighting factors for consideration.

Table of Contents

Hybrid Funds & Risk

Hybrid funds are designed to combine the potential for capital appreciation from equities with the stability of debt. The result is a spectrum of risk and return, shaped by how each fund allocates assets across stocks, bonds, and sometimes other instruments. For investors, the key question is how much risk you are willing to take and how long you plan to stay invested. By mapping risk profiles to specific hybrid fund types, you can choose a path that supports your financial objectives while keeping volatility within comfortable bounds.

Understanding Investor Risk Profiles

- Conservative or low-risk investors typically prioritize capital preservation and steady income. These investors often have shorter time horizons and prefer greater exposure to fixed income.

- Moderate-risk investors seek a balance between growth and stability, accepting some volatility for a more durable return profile.

- Aggressive or high-risk investors pursue growth over the long term and are comfortable with higher volatility and larger equity exposure.

So Hybrid funds can broadly be classified into 3 subcategories, based on risk profiles:

- Conservative/Low-Risk: Emphasizes capital protection with limited equity exposure and greater debt or cash components.

- Moderate-Risk: Aims for a blend of growth and income, usually with a balanced mix of debt and equity.

- Aggressive/High-Risk: Prioritizes growth, with substantial equity exposure and a smaller proportion of fixed income.

Conservative/Low-Risk Investors

- Typical equity exposure tends to be modest, with the majority in debt or cash equivalents.

- The focus is on stability and predictable income, making these funds appealing for preservation of capital.

Moderate-Risk Investors

- A typical balance between growth and income, with more room for market cycles than a conservative approach.

- Equity and debt portions are balanced to support smoother returns over time.

Aggressive/High-Risk Investors

- Higher equity tilt aims for stronger growth, accepting higher volatility and potential drawdowns.

- Time horizon is often longer to ride through market cycles.

Types of Hybrid Funds

In India, SEBI recognizes several hybrid categories that help investors align risk with asset mix. Below are definitions, asset ranges, and the risk profile they commonly serve.

Conservative Hybrid Funds

- Equity range roughly 10–25 percent; debt and cash the balance.

- Low risk, with the appeal of stability and modest upside potential.

- Why it matters: these funds can feel like debt with some growth potential, depending on market conditions.

Balanced Hybrid Funds

- Equity approximately 40–60 percent; debt 40–60 percent.

- Moderate risk with a blended growth and income profile.

- Why it matters: closer tracking of broader market cycles while maintaining diversification.

H3 Aggressive Hybrid Funds

- Equity about 65–80 percent; debt 20–35 percent.

- Higher risk, higher growth potential, and more pronounced price swings.

- Why it matters: suited to investors willing to endure volatility for potentially higher long-term returns.

Dynamic Asset Allocation (Balanced Advantage) Funds

- No fixed split; the manager shifts allocations between equity and debt as markets evolve.

- Moderate to higher risk depending on the phase of the market cycle.

- Why it matters: aims to dampen downturns by adjusting exposure automatically.

Multi-Asset Allocation Funds

- 3+ asset classes (for example equity, debt, and commodities or gold) with a diversified mix.

- Generally higher equity tilt than pure debt strategies, with broader diversification.

- Why it matters: can smooth periods of market stress through cross-asset diversification.

Arbitrage Funds

- Focus on arbitrage opportunities within equity markets, often combining hedged equity positions with cash/debt.

- Usually lower risk relative to pure equity funds, with volatility targeted lower than pure equity.

- Why it matters: tax-efficient potential and smoother performance in varied markets.

Equity Savings Funds (Optional category)

- Typically equity exposure with a substitute of hedging strategies and some debt overlay.

- Moderate risk with potential for steady income and reduced downside relative to pure equity.

Matching Funds to Risk Profiles

Directly mapping risk profiles to suitable hybrid fund types helps investors pick a path that aligns with their goals.

Suitable for Low-Risk Investors

- Conservative Hybrid Funds and Arbitrage Funds are commonly considered appropriate for investors prioritizing stability and capital preservation.

- Rationale: they offer lower equity exposure and potential for more predictable outcomes in uncertain markets.

Suitable for Moderate-Risk Investors

- Balanced Hybrid Funds and Dynamic Asset Allocation Funds can provide a balanced growth-and-income profile with a measured equity tilt.

- Rationale: these funds leverage diversification and opportunistic allocation to navigate market cycles.

Suitable for High-Risk Investors

- Aggressive Hybrid Funds and Multi-Asset Allocation Funds with significant equity components.

- Rationale: higher growth potential comes with higher volatility, aligned with a longer time horizon and willingness to endure market swings.

Other Considerations (Time Horizon, Tax, Costs)

- Time horizon matters. Longer horizons can help smooth the impact of market downturns on riskier hybrids.

- Tax treatment varies with the fund type and underlying instruments. It is important to review the scheme information document for tax implications.

- Costs such as expense ratios influence net returns. In India, expense ratios for mutual funds are disclosed in the scheme documents and can differ by plan type (regular or direct).

- Managerial approach and track record matter. Experienced fund management can help navigate volatility and cycling markets.

- For investors, the goal is to use these vehicles to achieve a cleaner risk-adjusted path to your objectives rather than chasing short-term returns.

Summary / Key Takeaways

Risk Profile to Hybrid Type mapping:

- Low risk: Conservative Hybrid Funds, Arbitrage Funds

- Moderate risk: Balanced Hybrid Funds, Dynamic Asset Allocation Funds

- High risk: Aggressive Hybrid Funds, Multi-Asset Allocation Funds

Typical equity ranges (illustrative):

- Conservative Hybrid Funds: around 10–25% equity

- Balanced Hybrid Funds: around 40–60% equity

- Aggressive Hybrid Funds: around 65–80% equity

Always align your choice with time horizon, tax considerations, and cost impact. Use the risk map as a framework to compare options rather than a prescription.

Frequently Asked Questions (FAQs)

Q: What exactly is a hybrid fund?

A: A hybrid fund pools assets across stocks, debt, gold, cash etc. to seek growth while dampening volatility through diversification.

Q: How do I map my risk tolerance to a hybrid fund type?

A: Start with your comfort level with volatility, your investment horizon, and income needs. Then compare the equity exposure of Conservative, Balanced, and Aggressive hybrids, along with dynamic and multi-asset options.

Q: Are hybrid funds taxed differently from pure equity funds in India?

A: Tax treatment depends on the fund’s equity exposure and category, so review the scheme information and applicable guidelines.

Q: What is a Balanced Advantage or Dynamic Asset Allocation fund?

A: These funds adjust allocations between equity and debt based on market conditions, aiming to balance growth with downside management.

Q: How long should I stay invested in a hybrid fund?

A: A longer horizon generally helps when the fund has a higher equity tilt, but every investor should align with their plan and risk capacity.

Q: What should I look for beyond risk mapping?

A: Consider the track record of the fund manager, diversification across assets, liquidity, and costs as part of your decision process.

Disclaimer: Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing. Past performance is not indicative of future results. The content above is for educational and informational purposes only and should not be construed as investment advice.