Types of Hybrid Funds: Aggressive, Conservative, BAF, and More

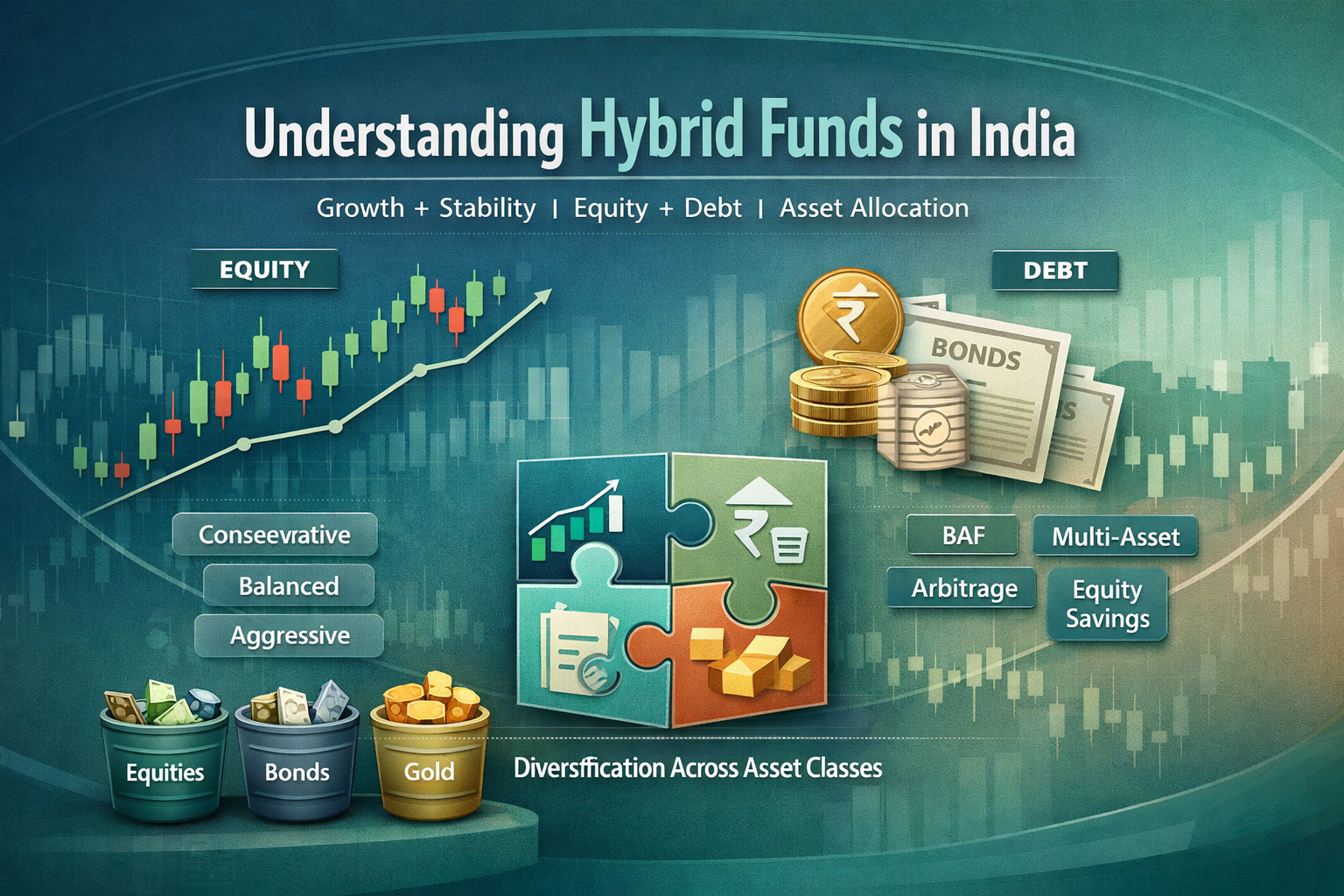

Hybrid funds are mutual funds that allocate across equity and debt instruments to balance growth potential with downside protection. In India, common categories include Conservative, Balanced, Aggressive, Balanced Advantage Funds, Multi-Asset Allocation, Arbitrage, and Equity Savings funds. This variety lets investors tailor risk and time horizons while keeping a single investing vehicle for diversified exposure. Hybrid funds have seen notable AUM growth in recent years, reflecting their relevance for many portfolios.

Key Types of Hybrid Funds

Conservative Hybrid Funds

Conservative hybrids invest a higher share in debt and a smaller slice in equity, typically about 75–90 percent in fixed income and 10–25 percent in equity. They aim for lower volatility and steadier income with potential for modest capital appreciation over a 1+ year horizon. Debt-heavy hybrids often behave like conservative fixed income with some equity participation.

Balanced Hybrid Funds

Balanced hybrids commonly maintain around 40–60 percent in equity and the remainder in debt. This mix targets a middle path between growth and stability, suitable for investors with a mid to long horizon of 3+ years. These funds are sometimes called Pure Hybrid or Balanced Hybrid funds.

Aggressive Hybrid Funds

Aggressive hybrids tilt toward equity, typically around 65–80 percent in equity and 20–35 percent in debt. They offer higher growth potential with greater volatility and are best suited to longer horizons. Equity taxation applies when equity exposure crosses the threshold, so gains may attract equity tax treatment beyond certain limits. Aggressive hybrids can deliver higher growth but come with increased market sensitivity.

Dynamic Asset Allocation / Balanced Advantage Funds (BAF)

BAF funds adjust their equity and debt allocations dynamically based on market valuations and risk signals. They aim to protect on downside by reducing equity exposure when markets look expensive and increasing it when valuations are favorable. These are active, flexible allocations, with a typical investment horizon of 3+ years. BAFs do not adhere to a fixed ratio, underscoring the dynamic nature of these strategies.

Multi-Asset Allocation Funds

Multi-Asset Allocation funds invest across at least three asset classes, often including equity, debt, and alternatives such as gold or real assets, with a minimum of 10 percent in each. The diversification across asset classes can help smooth returns in volatile markets.

Arbitrage Funds

Arbitrage funds blend equity exposure with scheduled arbitrage opportunities. They typically allocate at least 65 percent to equity/arbitrage strategies and hold a portion in debt. The objective is to capture price differences between cash and futures markets, with a generally lower sensitivity to broad market directions. Equity taxation generally applies for funds with high equity exposure, and debt components follow debt fund tax rules.

Equity Savings Funds

Equity Savings funds target at least 65 percent in equity-related allocations, often incorporating hedged positions and arbitrage to dampen volatility. They blend equity-like participation with downside protection mechanisms and aim for steadier outcomes with equity-style taxation for the large portion of equity exposure.

How to Choose a Hybrid Fund

- Align with goals and risk tolerance. If you prefer stability with some growth, Conservative or Equity Savings can fit; growth seekers with a longer horizon may favor Aggressive or Multi-Asset. Dynamic Allocation funds suit investors who want a hands-off active approach to allocation.

- Check tax implications. Debt-biased hybrids typically follow debt taxation, while higher equity allocation falls under equity taxation. Tax treatment can vary with structure.

- Review portfolio fit and costs. Compare typical expense ratios within your chosen category and ensure the fund’s asset mix aligns with your goals.

- Use a systematic approach. Consider creating a small set of candidate funds, then assess risk metrics, volatility, and track record in line with your time frame.

FAQs

- Q: What is the difference between an Aggressive Hybrid and an Equity Savings Fund?

- A: Aggressive Hybrids are equity-heavy with 65–80 percent in equity, aiming for higher growth with higher volatility. Equity Savings funds also hold substantial equity exposure but may incorporate hedging or arbitrage components for steadier outcomes, with equity tax treatment based on overall equity exposure.

- Q: Is a Balanced Advantage Fund safer than a Balanced Hybrid Fund?

- A: BA Funds adjust their allocations dynamically to market conditions, which can reduce downside risk in some cycles and increase exposure in favorable markets. Balanced Hybrids follow a fixed equity/debt range, offering predictability but potentially less protection in rapid shifts.

- Q: Which hybrid fund is suitable for a two-year goal?

- A: For short horizons like two years, Conservative hybrids or Equity Savings with lower equity exposure may be more appropriate due to reduced volatility. For any choice, review holdings, risk metrics, and expiry timelines.

- Q: Do hybrid funds pay dividends?

- A: Many hybrid funds distribute dividends or may opt for growth options. Dividend policies vary by fund and scheme; consult the scheme information document for specifics.

- Q: How do hybrid funds fit into a portfolio?

- A: They offer a way to diversify across asset classes within a single fund, complementing pure equity or pure debt holdings. They can smooth volatility and provide a blended exposure aligned to a moderate risk profile.

Conclusion

Hybrid funds provide a practical path to diversified, professionally managed exposure across asset classes. By understanding each category’s typical equity and debt mix, investors can match a fund type to their goals, time horizon, and tax considerations.

Disclaimer: Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing. Past performance is not indicative of future results. The content above is for educational and informational purposes only and should not be construed as investment advice.