Dynamic Asset Allocation (aka Balanced Advantage Funds): When to Consider

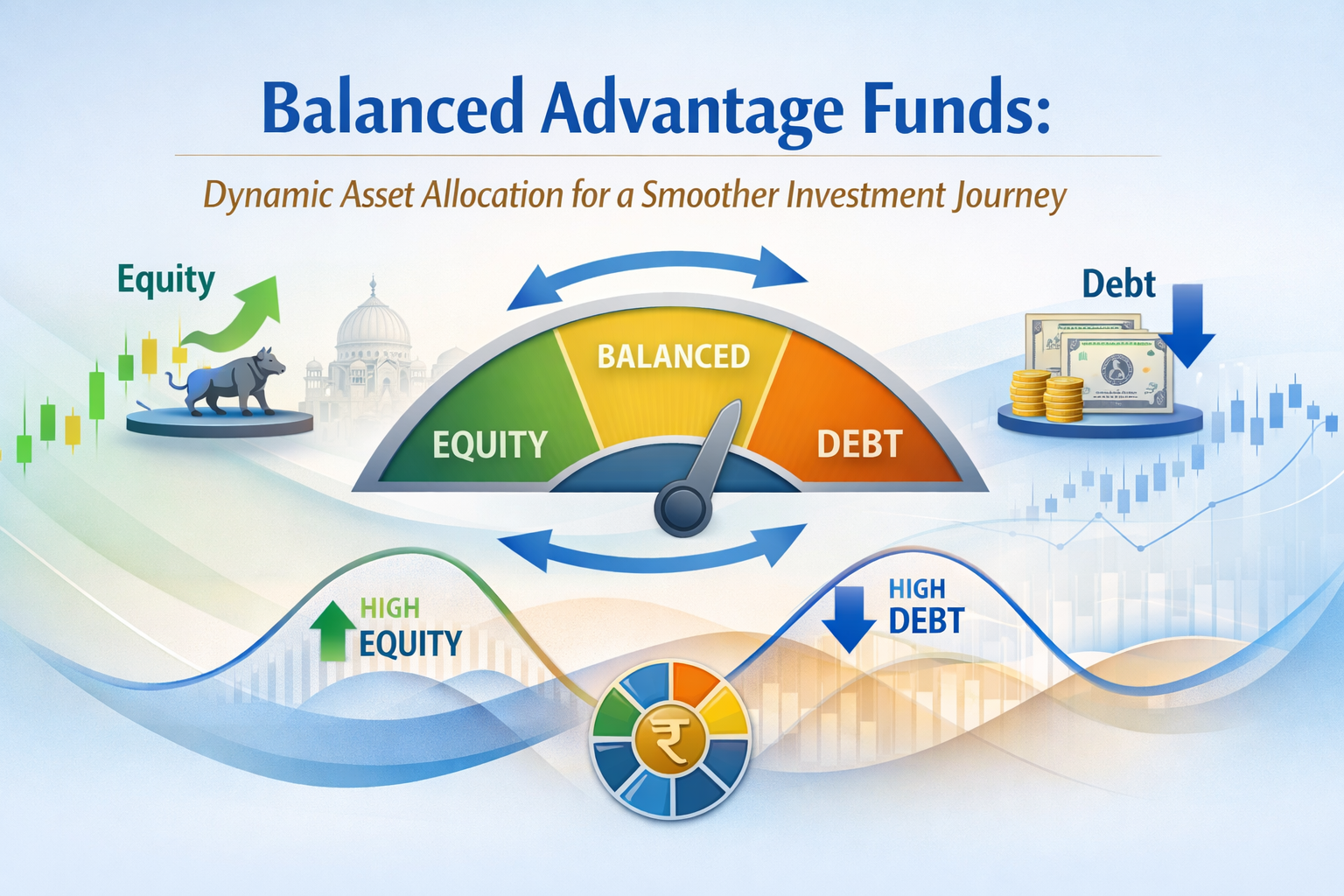

Dynamic Asset Allocation funds, often called Balanced Advantage Mutual Funds, are hybrid schemes that adjust the mix of equity and debt based on market conditions. In volatile times, this approach can help you participate in upside while dampening downside, which makes them relevant for investors seeking growth with a smoother ride.

I bring a practical, investor-focused approach to explaining how dynamic asset allocation can fit into a prudent Indian investor's portfolio in 2026. This blogpost presents a balanced, educational view while highlighting factors for consideration.

Table of Contents

What balanced advantage funds are

Balanced Advantage Funds are mutual funds that shift asset allocation dynamically between equity and debt. The core idea is not to fix a static split but to adjust exposure as market conditions change. This dynamic model aims to capture growth when equities look affordable and to protect capital by leaning more on debt when valuations are stretched.

How the dynamic model works

The funds rely heavily on portfolio rebalancing that decades of research has shown can help moderate volatility. Some schemes use counter-cyclical or pro-cyclical signals to guide scaling up or down equity exposure. The objective is to reduce drawdowns without abandoning upside potential in a recovery cycle. The approach is described as buy-low, sell-high within a managed framework.

In practice, managers may increase debt exposure when markets look expensive and raise equity exposure when prices look more compelling. This helps diversify risk across an investment cycle while aiming for a better risk-adjusted outcome than pure equity funds.

Key features and benefits

- Portfolio diversification within a single fund: The dynamic mix across asset classes can provide broad diversification and access to multiple drivers of return.

- Volatility management: By leaning on debt in stressed markets, these funds can potentially reduce sharp drawdowns during downturns, while still participating in recoveries.

- Market timing handled by experts: You do not need to time the market yourself, as trained managers adjust the allocation through the fund's model-driven process.

- Tax considerations: In some cases the fund’s equity allocation and tax treatment can differ from plain equity funds, depending on how much equity remains in the portfolio; consult the fund’s scheme information for the exact tax implications.

When to consider Balanced Advantage Funds

- Market conditions: High equity valuations or rising macro risks can justify a higher debt tilt to preserve capital, with the possibility to reallocate to equities as opportunities emerge.

- Volatile markets: If you want equity participation but with built-in risk control, these funds can offer a balanced path through cycles of volatility.

- Moderate risk appetite with long horizon: Investors seeking growth with a smoother ride than pure equity, and who can stay invested for 3 or more years, may find BAFs suitable as part of a diversified mix.

- Time-constrained investors: Beginners or busy investors who prefer a hands-off approach to rebalancing may appreciate the managed dynamic approach.

How Balanced Advantage compares with other funds

- Versus static balanced funds: Static funds maintain a fixed mix such as 65/35, while Balanced Advantage funds adjust dynamically. The dynamic approach can alter risk and return profiles based on valuation signals.

- Versus pure equity funds: BAFs aim to deliver growth potential with some downside discipline, but they may underperform in a strong bull market when downshifts to debt occur.

- Versus DIY approach: Some investors compare BAFs with a self-managed mix of separate equity and debt funds; research from Morningstar notes that a do-it-yourself route is possible but requires ongoing research and oversight.

Choosing a Balanced Advantage Fund

- Understand the strategy of AMC, fund and fund manager/team: Look for explicit dynamic models or track records of asset shifts rather than disguised fixed allocations. Transparency about the model helps you gauge risk and alignment with your goals.

- Review performance across cycles: Seek evidence of how the fund performed in bull and bear phases, not just in rising markets. Data points and charts from credible trackers can help compare defensiveness and growth phases.

- Assess the team: Check the fund manager’s experience and the stability of the investment team. Managerial continuity matters for model-driven strategies.

- Check costs and tax: Compare expense ratios and understand how the fund is classified for tax purposes, since dynamic allocation can influence tax treatment, depending on equity exposure levels.

- Taxation rules: Equity-like taxation can apply if the fund maintains a high equity allocation; confirm the tax treatment with the scheme information.

Conclusion and takeaways

Balanced Advantage Funds offer a dynamic path to growth with built-in risk management. They can be a useful addition to a diversified portfolio during volatile phases or when you prefer a hands-off, model-driven approach to asset allocation. As with any mutual fund, align your choice with your time horizon, risk tolerance, and financial goals, and consider a professional advisor for personalized fit.

FAQs

- Q: What are Balanced Advantage Funds?

- A: They are dynamic asset allocation funds that adjust the mix of equity and debt based on market conditions to balance growth and risk [Nippon India MF] [Source: Nippon India MF].

- Q: How do Balanced Advantage Funds work?

- A: Fund managers use model-driven signals to shift capital between equities and fixed income, aiming to buy when valuations are favorable and reduce risk when markets look extended [Nippon India MF; Advisorkhoj] [Sources: Nippon India MF; Advisorkhoj].

- Q: Who should consider Balanced Advantage Funds?

- A: Moderate risk investors with a longer horizon who want to participate in equity upside without full market volatility typically find them suitable [Navi; Morningstar India] [Sources: Navi; Morningstar India].

- Q: Are these funds taxed like equity funds?

- A: Tax treatment can depend on the fund’s equity allocation; some periods of higher equity exposure may lead to equity-like taxation, but verify with the specific scheme and current tax rules [Nippon India MF] [Source: Nippon India MF].

- Q: How do Balanced Advantage Funds differ from static hybrids?

- A: Static hybrids keep a fixed allocation, while Balanced Advantage Funds adjust the mix; this can lead to different risk and return profiles over cycles [Times of India; Nippon India MF] [Sources: Times of India; Nippon India MF].

- Q: When might Balanced Advantage Funds not be ideal?

- A: In a strong uptrend that lasts long, or when the manager’s model underweights equities during rallies, performance may lag; these funds also come with higher costs and complexity [Times of India; Value Research] [Sources: Times of India; Value Research].

Anchor texts for further exploration (See also)

- A: In a strong uptrend that lasts long, or when the manager’s model underweights equities during rallies, performance may lag; these funds also come with higher costs and complexity [Times of India; Value Research] [Sources: Times of India; Value Research].

Disclaimer: Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing. Past performance is not indicative of future results. The content above is for educational and informational purposes only and should not be construed as investment advice.